Comments

More posts

-

房子二貸:掌握房地產與金融策略的關鍵利器

-

Microcréditos Préstamos Solo DNI: La Mejor Opción para Impulsar tu Negocio en 2024

-

Servicii Complete de Autorizari ISU pentru Protecția Împotriva Incendiilor

-

专业妇科疾病诊所:守护女性健康的最佳选择

-

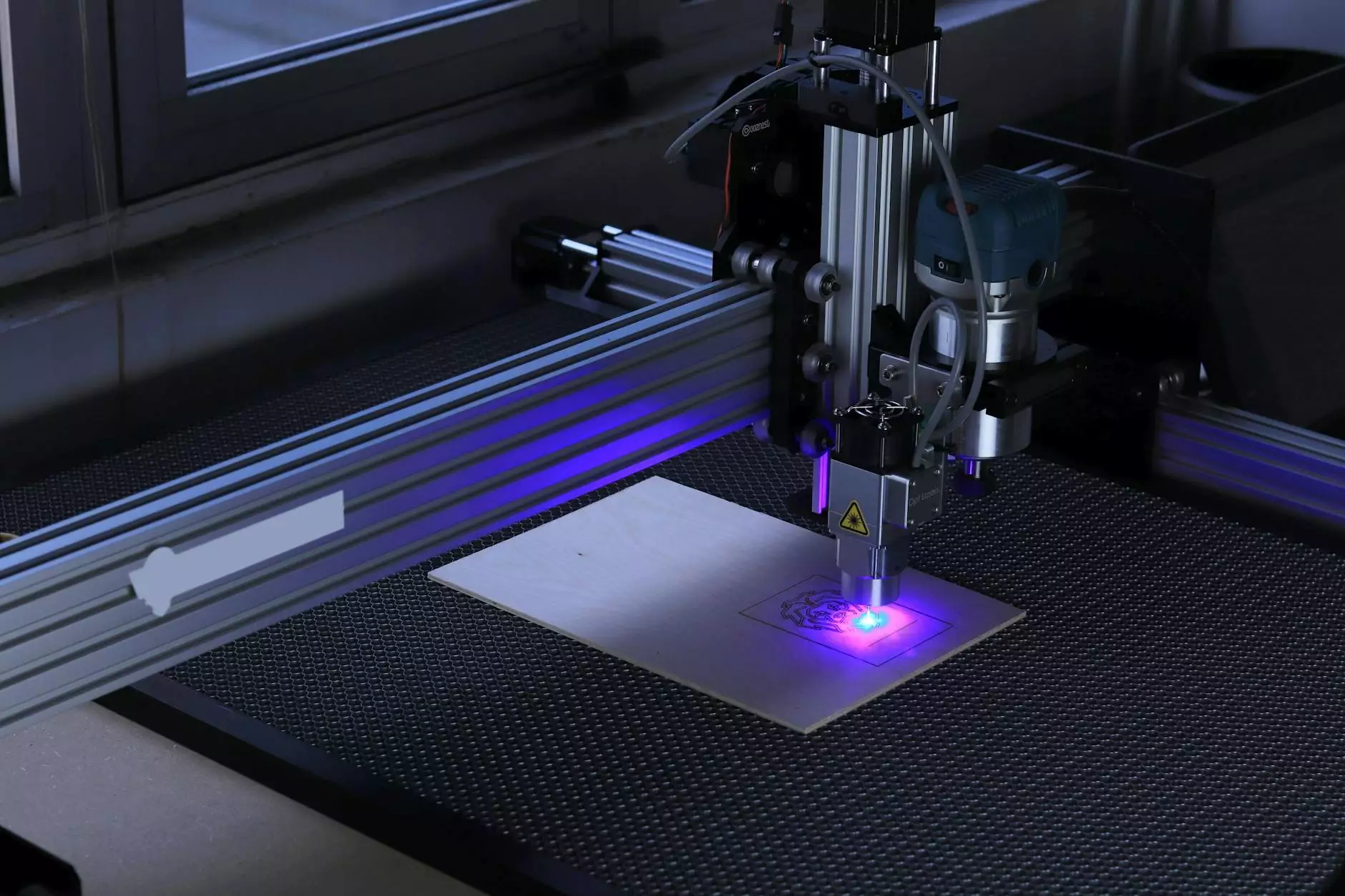

Maximizing Business Growth with China CNC Machining Parts Suppliers in the Metal Fabrication Industry

-

隆盛娛樂城註冊:打造頂級線上娛樂體驗的秘密寶典

-

全面剖析 体育 下 注:提升您的博彩策略与盈利能力

-

Cuidador de Idosos: A Chave para uma Vida de Qualidade na Terceira Idade

-

Αποφράξεις Αθήνα - Ο Απόλυτος Οδηγός για Υπηρεσίες Αποφράξεων

-

全面解析 百 家 樂 直播:开启线上赌场新纪元